Special topics

Ghana’s oil and gas industry watchers want upstream players to pay progressively higher taxes to the State, in every new exploration agreement, arguing that would reflect a superior take for the country from its potential hydrocarbons endowment.

But that’s a miscalculation.

Current running commentaries by most analysts is that the world’s leading supermajor, Exxon Mobil’s entry into Ghana’s ultra-deep could have been secured on better terms if it had been through open tender, which hopefully would have jacked up the financials in Ghana’s favour.

That may well be, however, the so-called supermajors such as Exxon Mobil and the rest of the Big Oil pack, are much more. They come with varying degrees of expertise and technology that are almost exclusive to each player, which should be of more importance to a frontier territory that is yet to be de-risked.

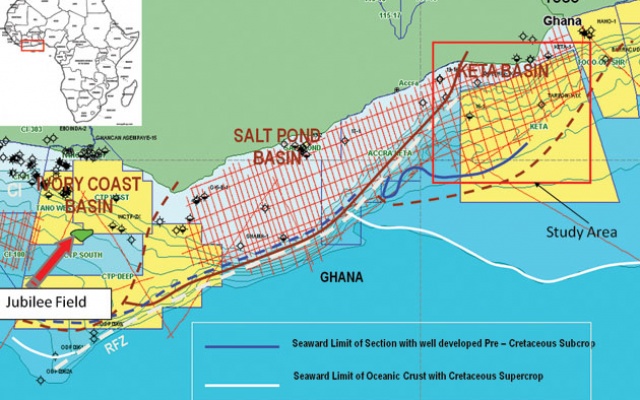

The idea that Kosmos Energy and Tullow’s operations in the Jubilee and TEN fields have made all of Ghana’s offshore attractive, is flawed. While the Jubilee and TEN operations are in water depths of up to about 1,100 metres, Exxon Mobil’s block is in the range of 2,000 to 4,000 metres deep – a more difficult terrain that is yet to be de-risked.

The signing of the agreement for the Deepwater Cape Three Point offshore (DWCTP) oilfield followed direct negotiations between Ghana and Exxon Mobil without an open competitive tender due to the nature of the field.

In a déjà vu sort of way, one can recollect that most oil companies that had prospected in Ghana’s shallow waters in the Western Region were all leaving – considering Ghana’s offshore as the backwaters of the Gulf of Guinea’s oil territory – until the sweetener of a Petroleum Agreement that got Kosmos and Tullow to take a risk with the West Cape Three Points and Tano offshore fields that are yielding good outcomes and have drawn in other players into that range of water depths now.

In the case of Deepwater Cape Three Point offshore (DWCTP) oilfield, where Exxon Mobil have moved in, important players including Vanco Oil and Russia’s Lukoil have left after prospecting in the shallower depths of that territory.

Baiting ExxonMobil into that territory alone could be a positive signal to other majors, thereby heightening interest in Ghana’s ultra-deep waters. And given Exxon Mobil’s track record and its superior technology in such water depths, chances are they could de-risk those depths in a good enough time to make it really attractive, thus helping Ghana to subsequently enter into superior petroleum agreements, reflecting a new and better status.

The point is, betting on the best to hit oil quickly in that difficult terrain could be a better gamble, especially in this yoyo-type industry where time is of essence if one is to benefit from its flippant boom and bust cycles. And one should not forget that with current global efforts at shifting to cleaner sources of energy, hydrocarbons will not be as important within the next 50 years as it had been in the past 50. By strictly sticking to the script, Ghana may miss the moon, chasing after the stars.

A case that buttresses this point is Aker Energy’s takeover of operatorship of the Deepwater Tano-Cape Three Points (DWT-CTP) block, after agreeing a US$100 million deal to acquire Hess’ local subsidiary that currently runs the field development project.

There have been expressions of misgivings why an indigenous Ghanaian company or consortium didn’t snap up this opportunity, given the low amount involved, more especially as the DWT-CTP block, covering 2010 square kilometres, is estimated to hold discovered contingent resources of 550 million barrels, with another 400 million barrels in prospective upside volumes.

What proponents of this argument may not have addressed their minds to is further funding of the field’s development to produce oil, not to mention access to technology and other know-how for a successful operation.

Aker has said it “is uniquely positioned to combine technological know-how from the upstream oil and gas industry with its extensive experience in oil services to deliver a successful fast-track project.”

The company has disclosed that it has agreed on a long-term collaboration with software company Cognite to accelerate the development of digital solutions that will drive major efficiencies through the entire life of an energy asset.

The energy services company will use Cognite’s advanced industrial data platform to collect and analyse large volumes of data from offshore energy installations, providing solutions that will enable customers to make informed decisions about an energy asset at any stage of its lifetime. This will reduce costs, lower risks and improve performance.

Arguably, it is this sort of advantage which an upstream firm of proven track record brings to the table that frontier countries such as Ghana must seek to bait, rather than always looking at the tax revenue to be made from the sale of oil blocks.

To paraphrase the Ghana National Petroleum Corporation’s (GNPC) chief executive, Mr KK Sarpong, such collaboration will lead to further successes in the ultra-deep water Tano basin of Ghana and enable the transfer of knowledge to the Ghanaian oil and gas industry.

Ultimately, the transfer of knowledge from the best operators in the industry will help the country develop its industry with Ghanaians in a commanding role. This should inform decisions, as much as tax revenues – perhaps even more.